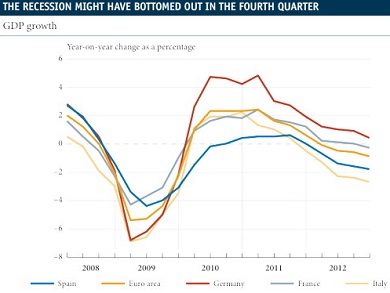

The euro area’s GDP shrank by 0.6% in the fourth quarter, a larger drop than expected, leaving the year-on-year change at -0.9% and the variation for 2012 as a whole at -0.5%. There are widespread signs of weakness as the four main economies of the euro area all experienced negative growth. However, the gaps between them are significant in quarter-on-quarter terms: Germany (-0.6%), France (-0.3%), Italy (-0.9%) and Spain (-0.8%).

Although France posted the smallest contraction, its trend in 2013 is the one that has raised most questions. While leading business indicators for the first quarter for the euro area as a whole show signs of improvement, particularly in Germany, the signs of fatigue in France continue to accumulate. For example, the French Purchasing Managers’ Index (PMI) fell to 42.3 points in February, a figure clearly in the zone of contraction and similar to those posted during the 2009 recession. Both the index for services and for manufacturing in the first quarter are lower than the levels recorded in the fourth quarter.

This contrasts with the trend of German indicators. While the PMI for the services sector has spent the last three months above the value of 50, which marks the boundary for expansion, the manufacturing sector crossed this threshold in February and reached 50.1 points. Similarly, the German business index, Ifo, rose sharply in February, reaching its highest level for the last ten months. This suggests that Germany will once again lead the way on the euro area’s road to recovery.

The greater divergence between Germany and France is also reflected in other indicators, such as the economic sentiment index. While the German indicator rose by 2.5 points in January, the French indicator fell by 0.3 points. This disparity is also highlighted in the labour market: France’s unemployment rate still has an upward trend and reached 10.3% in 2012 as a whole, contrasting with the German rate which is falling and at an all-time low, namely 5.5%.

For the time being, in spite of the French economy’s bad performance, Germany’s strength, together with some signs of stabilization in the periphery countries, means that euro area indicators continue to improve as a whole. For example, the PMI for services and manufacturing stood at 47.3 and 47.8 points, respectively, both figures higher than those recorded in the fourth quarter. For its part, the euro area’s economic sentiment index posted a value of 89.2 points in January, compared with an average of 86.5 points for the fourth quarter. Regarding demand, consumer confidence in the euro area also shows signs of improvement in January. This confirms that, for the time being, the German recovery is overshadowing the weakness of the rest of the countries.

This improved confidence in the euro area augurs relative optimism regarding the performance of economic activity in 2013. In its winter forecasts the European Commission (EC) predicts a moderate recovery in growth throughout the year but at differing speeds. Some countries will start this recovery earlier, such as Germany, while others, such as Spain, will not achieve growth until the second half of the year.

Nonetheless, the EC has revised its euro area growth forecast down from its November forecasts. For 2013, it expects GDP to fall by 0.3%, 0.4 percentage points less than in October. This revision is largely due to the base effect of a worse fourth quarter than expected and the growth forecast for 2014 is still 0.8%.

These downward revisions are in line with the findings from the European Central Bank survey of professional forecasters for the fourth quarter of 2012. According to the analysts polled, GDP growth in the euro area will be 0.0% in 2013 and 1.1% in 2014, 0.3 and 0.2 percentage points less than forecast in the third quarter survey, respectively. Given that this survey was carried out before the fourth quarter figures were released, the base effect due to lower than expected growth means there will probably be further downward revisions. The growth prospects for 2015 stand at 1.6% and for 2017 at 1.8%, indicating that analysts believe GDP’s growth potential has not been significantly affected during the crisis.

In short, relaxation of financial tensions in the periphery countries and the prospect of a recovery during this year should encourage the agenda of structural reforms supporting growth to be continued, as well as continuing with fiscal consolidation to guarantee the sustainability of public accounts. This is the only way to ensure prosperity for Europe’s economy.

Be the first to comment on "The German economy will sustain Europe’s recovery"