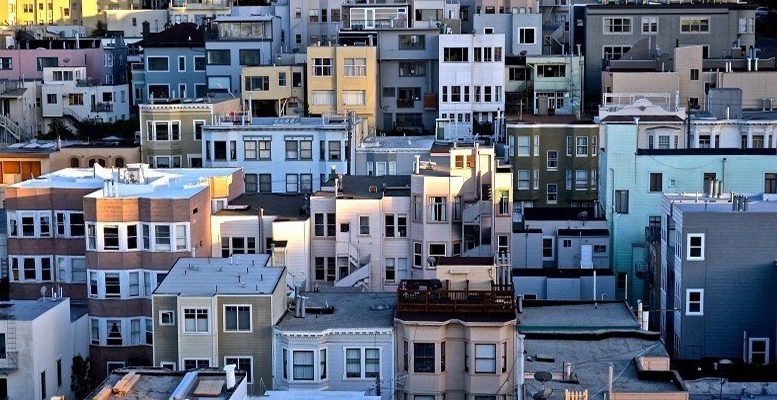

Bank of Spain warns government that housing policy – rent cap etc. – is having opposite effect to that intended

The Bank of Spain reviews the main real estate measures promoted by the Government, both in the purchase and rental segments, and concludes that they could end up resulting in an increasingly smaller market with higher prices. The BdE analyses rental price controls, a measure introduced temporarily by the decree on anti-crisis measures after the Russian invasion of Ukraine but made permanent by the housing law passed in April last…

Read More