Across continental European countries, Italy has fallen from a margin leader in the pre-crisis to a margin laggard today. Margins in Germany improved and are now above pre-crisis levels while Spain appears to be seeing a rebound.

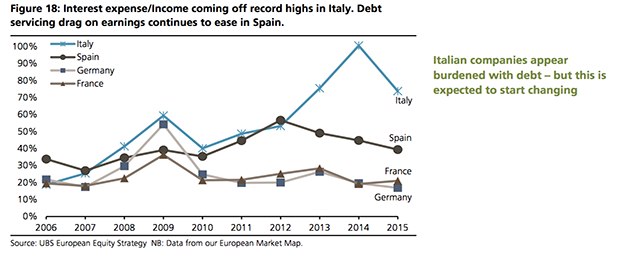

The debt burden on Italian companies ballooned between 2012 and 2014 (Figure 18), however this is expected to reduce in 2015. Spanish interest cost on the other hand decoupled from Italy in 2012 and the country has seen easing debt servicing costs since then. After a spike in 2009, Germany continues to hold some of the lowest interest cost/income ratios in Europe.

ROE (Du Pont analysis)

As we discussed above, net margins are expected to recover in 2015 and continue to improve in 2016 after significant fall between 2010 and 2013 (Figure 19). However, an expected reduction in asset turnover and further deleveraging hold ROE down. The drop in asset turnover is mainly driven by the Energy sector and other areas of the market show broadly flat turnover. In this context we expect companies that re-leverage to be able to reap benefits in ROE terms (for more see: Q-Series®: Global Equity Strategy – Where Will $1tr Per Year in Corporate Cash Go? A Post-Crisis Corporate Balance Sheet Tale, 23 Feb 2015).

Be the first to comment on "Earnings growth expected to rebound in Spain and Italy (UBS)"