Just because most European languages attach a semantic Spartan-like element to the term austerity, it doesn’t follow that austerity must obviously be a more consistent policy than, let’s say, a profligacy programme. Common ancient history aside, the increasing doubts about the German and French economies doing well in spite of the stress the euro zone is going under, tells us that austerity plans currently in place in euro peripheral States were not thoroughly thought.

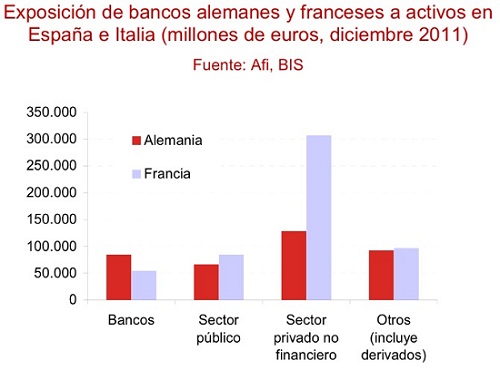

There are at least two reasons why the pain in southern Europe is believed to destabilise core Europe. One is that German exports to Spain and Italy are over 10 percent of the total, and 15 percent in France’s case. And the second one is their banks’ exposure to Spanish and Italian financial assets across the board, from banks to the public and private sector and derivatives. The latest Bank of International Settlements data show, in millions of euros, in December 2011, the extent of the possible risk, that is, almost a trillion euros:

Be the first to comment on "The soft core of core Europe"