Barclays analysts released the following comments on EU inflation on Monday:

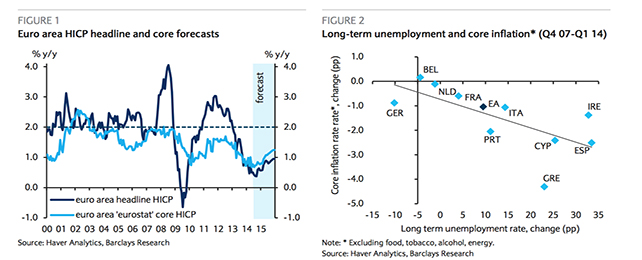

We continue to expect euro area inflation to average 0.5% this year and 0.8% next. Downside risks dominate our projected outlook (Figure 1). Domestic demand weakness and the lagged pass-through effect stemming from a protracted strong euro exchange rate will likely weigh on the NEIG component in the coming months. In addition, a food inflation recovery is likely to unfold only gradually as unprocessed food prices are set to remain under pressure due to base effects related to last year’s sharp rise.

The potential effect of protracted labour market slack on inflation

Since the end of 2007, changes in core inflation and long-term unemployment rates have been negatively correlated in the euro area (Figure 2). Between the end of 2007 and the beginning of 2014, long-term unemployment increased by 9.5pp while core inflation (ex. food, tobacco, alcohol, energy) declined by 1.0pp. Similar patterns can be identified at country levels, including in France, Italy and Spain.

Since the onset of the global financial crisis, there has been also a change in the relationship between the unemployment rate (UR) and vacancy rate in the euro area. This relationship, summarized by the Beveridge curve, was very stable from 2006 through the beginning of 2010, tracing a negative relationship between unemployment and vacancy rates (Figure 3). However, between Q2 2010 and Q4 2011, the vacancy rate trended upwards while the unemployment rate remained broadly stable at about 10%. This change in the relationship caused a rightward shift of Beveridge curve, which has since returned to show a negative correlation between unemployment and job vacancies.

Such shifts are commonly interpreted as representing declines in the efficiency of matching job seekers with available jobs through reduced incentives for jobless workers to get work and increased obstacles to job matches.

We are aware that it may be misleading to rely on short-term Beveridge curve movements to infer the extent of structural unemployment over the longer term. We think though that the dissolution of the relationship between unemployment and vacancy rate stems from structural changes in the composition of the euro area working age population, such as an aging population and gender dynamics. This could have a permanent impact on the long- term inflation outlook through wage-setting channels, in our view.

In Q1 14, labour force participation (LFP) reached 72.3%, the highest level on record. Female labour force participation was 66.3%, increasing more than 5pp since 2005 and similar to the LFP dynamic in the 55+ age cohort. The relationship between LFP and the UR has changed as well, with the correlation reversing: from being negative (-0.90) between 2005 and 2009, it turned positive (+0.96) between 2009 and 2014, approximately when traditional negative relationship between unemployment rate and job vacancies depicted by the Beveridge curve broke up (Figure 4).

Targeted reforms are key to avoiding downward shift of inflation equilibrium

We think it is possible that the long-term inflation equilibrium may shift downwards after remaining close to 2% since the inception of the euro area. The newly established positive correlation between LFP and UR, along with our expectation that LFP will continue to increase over time, implies that labour market slack absorption will likely be slower than in the past for given growth potential. This would continue to increase long-term unemployment and exert downward pressure on consumer prices.

Structural reforms aimed at expanding the labour-absorption capacity of euro area economies will be essential to avoid a persistent disinflationary effect on wages. Incentives targeted at females and older workers would help absorb the rapidly growing labour supply into productive employment. Along with that, increasing the effective retirement age and adjusting pension benefits to fair actuarial levels would also help elder workers find jobs. Finally, active labour market policies would also help support employment creation.

Be the first to comment on "Europe: Quo vadis inflation?"