This surprising decision comes after meaningful progress had been achieved over the past two weeks on reform measures that would unlock the remaining funds of the second bailout (EUR7.2bn). Most policymakers and markets expected that a deal on a programme extension was within reach before the current one expires on 30 June. As our latest client survey suggests, markets have been complacent about Greek risk: a majority of investors believe that a Greek exit will be a small negative for markets and only 23% expect a Greek exit to happen within the next three months. While there is still a slight chance that the referendum is called off if it is found unconstitutional, we think that this is unlikely.

High volatility in the run-up to the referendum. As the prospects of a deal before 30 June vanish, the Eurosystem has decided today not to increase the Emergency Liquidity Assistance (ELA) beyond Friday’s 26 June level. The Greek government was left with no choice but to declare a bank holiday until 5 July. And although it was not formally announced at the time of writing, we believe it should also enact capital controls to avoid a meltdown of the entire Greek banking system (the experience of Cyprus in 2013 is a reference for such controls). The EA institutions have stated that they stand ready to mitigate contagion. The ECB has indicated that it is determined to use all the instruments available within its mandate to preserve stability. We think this could include further front-loading of the ECB’s QE if periphery sovereign spreads were to increase significantly.

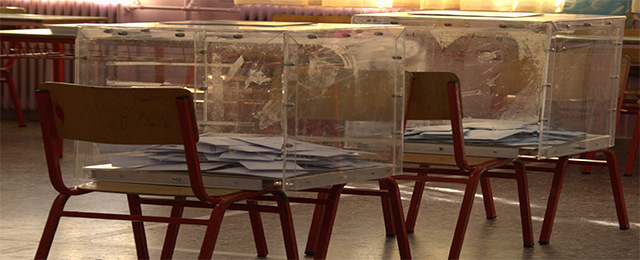

A victory for a “yes” vote may trigger a national-unity government. In the event of a “yes” vote, we think that it is highly likely that Greek PM Tsipras and possibly the entire government would step down, even if other options are also possible, such as PM Tsipras staying in power and accepting the deal with the Institutions. After PM Tsipras steps down, moderate Syriza MPs could join other moderate parties (PASOK, Potami and ND) into a national-unity coalition. The new government would re-engage with the Institutions to sign an agreement as per the mandate given by the referendum. Snap elections would remain a possibility in this scenario, but probably not until after the summer. Market reaction would likely be positive immediately after the referendum. However volatility is likely to remain elevated until a new and stable government is put in place and a programme is approved.

A “no” vote makes exit the most likely outcome. Without the support of a programme, a potential exit scenario would resemble Argentina’s 2001-02 crisis, which also started with deposit controls but – in the absence of an internationally supported plan – rapidly deteriorated into tighter.

Be the first to comment on "Greek referendum: A victory for a “yes” vote may trigger a national-unity government"