Kuroda’s farewell

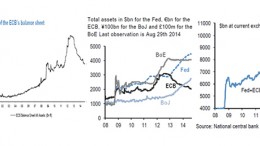

The Bank of Japan (BoJ) early this morning left its key short-term interest rates unchanged at -0.1% and its 10-year bond yields near 0% by a unanimous vote at its March meeting. The central bank also made no tweaks to its yield control curve, which includes a 0.5% cap on bond purchases, tempering views that monetary policy side effects need to be addressed soon. Meanwhile, BoJ board members signalled their…