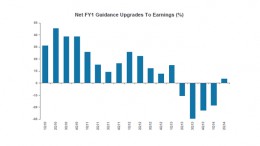

European earnings: 2Q 2014 the strongest since 1Q 2012

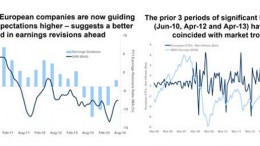

MADRID | The Corner | Now that the earnings season in Europe has finished, Morgan Stanley analysts point out that, excluding small caps, there are 4% more companies that have beaten estimates versus those that have missed them. Therefore, this last quarter has been the strongest since 1Q12. The IT and consumption sectors are those with the best results. Moreover, Europe comes back in the 2Q to the EPS growth (3.7% above the expectations) and the companies start to raise revenue guidance.