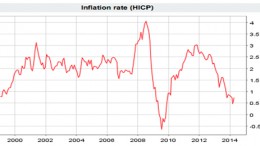

ECB: two quotes, one graph

MADRID | The Corner | Mario Draghi: “Some form of cross-country risk-sharing is essential to help reduce adjustment costs for those countries and prevent recessions from leaving deep and permanent scars.”/ Jens Weidmann: “Fiscal policy should support the central bank with solid state finances, so that monetary policy can concentrate on its actual mandate, and sustainably secure the value of money.”