In its September 19 debut, Alibaba’s shares closed at US$ 93.89 under the ticker symbol BABA on the New York Stock Exchange, a 38 percent surge from the US$ 68 offering price. Investors said the increase met their expectations.

“Considering the market reaction, Albiaba set the IPO price quite low, so getting the shares meant earning money,” one fund manager said.

A source close to the IPO said 1,700 institutional investors subscribed to Alibaba shares, which were oversubscribed 14 times.

The frenzy signals investors’ optimism on the company’s business outlook backed by China’s exploding e-commerce market. According to market research institution IDC, the value of all the merchandise transactions on Alibaba’s platforms totaled US$ 248 billion in 2013, greater than Amazon and eBay combined.

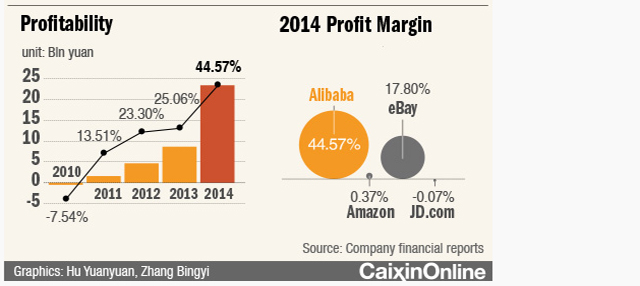

*Check the graph explaining Alibaba’s business at Caixin magazine.

Be the first to comment on "Alibaba’s big deal"