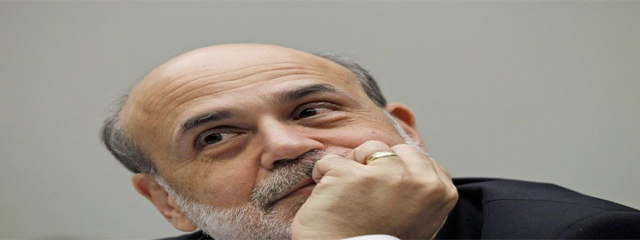

Alan Goolsbee writes in “Bravo for Bernanke and the QE Era”:

There is a valid debate to be had about how much longer the Fed’s loose monetary policy should continue and about the risks that might be entailed. But looking back at the period since 2010, it is clear that the Fed was right to try to help improve the country’s financial health, avoiding deflation, and the critics were wrong that QE would cause inflation and harm the economy.

Think back to the days before the 2008 crisis or recession. If confronted with the scenario that would follow—five years of GDP growth of only around 2% a year, five years of unemployment rates around or above 7%, core inflation consistently below 2%—the near-universal response of economists would have been for the Fed to cut interest rates.

The problem, of course, was that the target federal-funds rate was already at 0% by the close of 2008—the start of the five years in question. So the Fed tried to loosen monetary policy by buying assets and by issuing forward guidance on rates. Mr. Bernanke said from the outset that these measures were only the monetary equivalent of those ugly flap-ear hats—uncomfortable, yes, but not a forever thing. Just wait for the vortex to pass.

Oh yes! The critics were way off base! Especially because monetary policy, despite all the QEs, remained overtly tight!

Read the whole article here.

Be the first to comment on "Bernanke has been found wanting"