It is very easy to construct economic theories in which deflation is a trap. Irving Fisher’s debt deflation theory of depressions is an example from the early 1930s. The most common of these now is the much simpler, so-called Keynesian liquidity trap, which goes like this: if the nominal interest rate is at its lower limit of zero, then a sustained deflation implies a positive real interest rate that could, in principle, be higher than the real interest rate required to secure an economic recovery.

It is even easy, in theory, to construct cases in which the economic dynamics are destructively unstable, for example, if the weak economy leads to more rapid deflation that, in turn, implies an even higher real interest rate, an even weaker economy, even greater deflationary pressures and so on until, presumably, the economy vanishes behind some sort of financial event horizon and is never heard from again.

Pretty chilling stuff, and if the headlines that accompanied last week’s release of the euro area’s December consumer price inflation are any indication, there is a reasonably widespread belief that the deflation trap is not just a theoretical curiosum but a genuine risk for Europe.

We think that anxiety about the deflation trap is largely based upon a reading of Japanese history that dates back to an influential 1998 paper by Paul Krugman, which argued that Japan faced just such a liquidity trap that could best be addressed by raising inflation expectations to alleviate the putative problem of an excessively high real interest rate.

Japan’s experience being one of very few significant deflationary episodes in recent history (Argentina’s deflation in the late 1990s and the ongoing deflation in Southern Europe are the others), it looms large as a precedent. But does the precedent suggest that deflation is a trap?

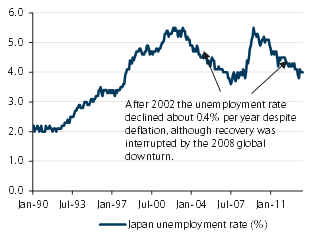

We are not convinced. The relevant history begins in the early 1990s and encompasses what we think should be viewed as two quite distinct periods. During the first decade (1990-2002), Japan faced an almost uninterrupted series of economic shocks and dislocation. The first, and arguably most severe, of these was the collapse of the ‘bubble economy’ of the 1980s, which was compounded by the abrupt and almost simultaneous demographic transition from a growing to a shrinking population. By 1996, the labor market seemed to be stabilizing (Figure 2), but the economy was soon undermined by the Asian financial crisis. In 1999, the labor market once again showed signs of stabilization, although at a very high rate of unemployment by Japanese historical standards, but the economy was yet further undermined by the collapse of the US (and global) equity bubble.

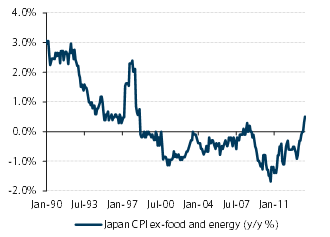

Policy deficiencies may well have contributed to the weak performance during this first decade after the collapse of the bubble economy; for the purposes of this discussion, we feel no need to take a stand on this. The salient fact is that some combination of economic dislocations and (perhaps) policy shortcomings left the Japanese economy with a very weak labor market and very low inflation by the mid-1990s, which gave way to price deflation by around 1998.

The deflation intensified as the economy weakened further after the 2000 equity market collapse and again after the 2008 global economic downdraft. Although these events were to some extent probably unforeseen in Japan, we think it is safe to say that a mild deflation was a well-understood element of the economic and financial context during 2002-13. If deflation is a trap, Japan was entangled for most, if not all, of this period.

In this context, it is important to note – and, we think, underappreciated by the global commentariat – that the 2002-13 period of deflation was also one of sustained economic and labor market recovery in Japan, at least as measured by the rate of unemployment, although that recovery was interrupted, as it was around the world, by the 2008 economic downdraft.

The periods of labor market recovery that bracketed the 2008 recession had a fairly steady decline in the unemployment rate that averaged about 0.40 percentage points per year. This is slower than the average improvement during (for example) the three episodes of labor market recovery in the US since the early 1990s, in which the unemployment rate dropped an average of about 0.57 percentage points per year.

But the cyclical spike in unemployment has also been much larger in the US than in Japan, and the policy framework associated with the US labor market recoveries of the late 1990s and the post-Nasdaq period are implicated in the minds of some in the equity and credit market booms and the subsequent collapses that interrupted the economic recoveries.

After the disruptive collapse of the bubble economy of the 1980s, Japanese policy authorities were long reluctant to flirt with the risk of policy-induced financial instability. Whether this represented an excess of caution we leave to our readers to decide for themselves.

We are not suggesting that deflation is costless. An extended deflationary episode would complicate the debt dynamics of vulnerable Southern European economies and could be destabilizing for that reason. It makes good sense for policy authorities to aim for enough inflation to mitigate this complication.

But the word trap connotes a device or situation from which it is impossible to escape without some outside intervention, good luck, or abnormal and extraordinary efforts. In some theories, deflation is just such a trap, which enforces a potentially intractable stagnation or even a downward economic and financial spiral. Some day, in some economy, deflation may prove to be such a trap. In Japan, we think it was not.

Figure 1

Figure 1

Japanese inflation fell to a very low level in 1994, and deflation began around 1998. Source: Haver Analytics

Figure 2

Figure 2

But the sustained deflation did not prevent a recovery of the labor market after 2002. Source: Haver Analytics

Be the first to comment on "Is deflation a trap? Revisiting the Japanese experience"