It’s not Friedman that was wrong, but Paul Krugman:

“Friedman’s money supply rule soon proved itself inadequate, but a more flexible kind of monetarism — one that still left no role for fiscal policy — did end up ruling conventional wisdom from the mid-80s to 2007, the era of the Great Moderation. Then came the Great Recession, the Fed funds rate came up against the zero lower bound, and we werebanished from the monetarist paradise. In fact, as I’ve written on a number of occasions, recent experience pretty conclusivelyshows that Friedman’s claims about how easy it would have been to avert depression were all wrong.”

“Still, QE, in the eyes of its most enthusiastic advocates, can return us to Milton’s Eden. And they are determined to read the evidence as confirming that hopeful notion.”

“Yet there are many economists, myself included, who regard this view as highly unrealistic, yet support more aggressive Fed action all the same. Why? First, because it might help and is unlikely to do harm. Second, because the alternative — fiscal policy — may be of proven effectiveness, but is also completely blocked by politics. So the Fed’s efforts are all we have.”

PK supports monetary policy because it’s a placebo. It can do no harm and, who knows, ‘psychologically’ it might help!

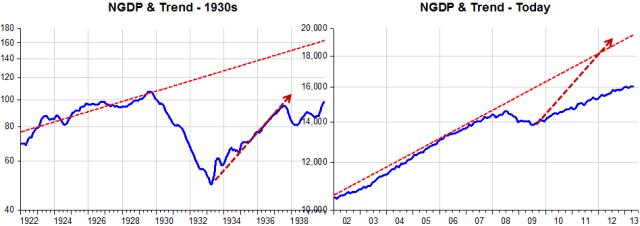

Imagine if FDR thought the same in early 1933. He probably wouldn’t have thought delinking from gold would be worth the trouble! As the charts (reproduced from the previous post) indicate, Friedman was right to claim how easy it would have been to avoid the depression, given how easy it was to turn the economy around. Today, on the other hand, we are content with remaining ‘depressed’.

And what about the “proven effectiveness of fiscal policy”? The charts show that while between late 2007 and 2009 the deficit more than quadrupled, employment tanked (Note that when QE1 came online the rate of fall in employment was reduced) and in 2010-13, while the deficit was almost halved employment increased consistently (less than what would be desirable because monetary policy is still keeping the economy depressed).

But to PK acolytes, he can never be wrong..!

Be the first to comment on "Monetary policy for depression"