“The property sector is the most important sector in China, considering its extensive linkage with other industries and importance in driving domestic growth and credit cycles,” comment UBS analysts. Therefore, they expect recent and further policy easing to help support property sales, starts, and construction in the run up to and around the “golden season” this fall.

UBS comments are as follows:

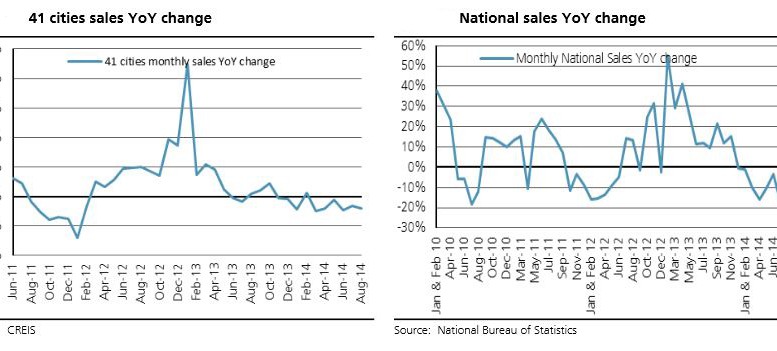

However, near term policy easing and improvement notwithstanding, we believe the property downturn reflects a structural turning point in the sector, and that policy easing can only help stabilize but not turn around the downshift. We expect commodity housing starts and construction to slow further by year end and into 2015, weighing more heavily on the economy.

In our earlier reports and forecasts, we had assumed that property policies would be increasingly relaxed and that construction and sales would improve in the summer/fall months. Even with additional policy easing including cuts in mortgage down payment requirement and rates, we see property sales and starts declining further in 2015 and GDP growth slowing to 6.8%.

Although the earlier than expected relaxation of property policies has boosted market sentiment, structural issues in the sector remain. As such, we think the rerating will be capped by the higher leverage, falling margins, and high inventory levels of some property companies. After the rally, the sector forward PE is now at 7.4x 2014 PER, equivalent to negative 0.7 SD below the historical average. Our key picks in the sector are Shimao, KWG, and Vanke.”

Be the first to comment on "Further policy easing to support China’s property downturn"