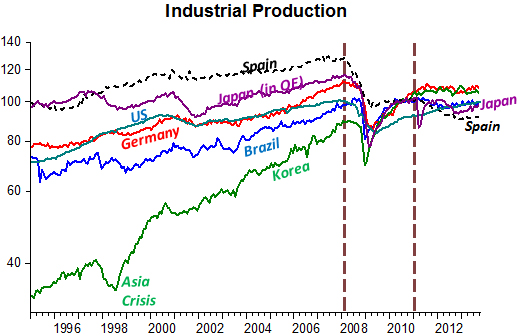

It would be interesting to check that world recovery, either in terms of industrial output or trade, petered out at the same point in time (at the turn of 2011). I only consider industrial production because trade is dependent, to a large extent, on what is happening to manufacturing activity.

I selected a group of “representative” countries. The US, Germany and Japan, together, account for more than one third of world output. Spain represents the “south” (of Europe), while Korea and Brazil are “representative agents” of newly industrialized and emerging markets, respectively.

Points to note:

1)Korea and Brazil “hold out” for longer and begin the ebound sooner.

2)The other countries fall and begin the rebound together.

Spain´s ‘rebound’ means production stays flat.

3)All countries stop rebounding at about the same time (late 2010/early 2011)

4)While production in other countries stay ‘flat’, Spain experiences a second drop.

5)For the past year (since the start of Abenomics) Japanese output trends ever so slightly up.

6)During the QE between 2002 and 2006 Japanese industrial production showed a marked upward trend. Likely this will happen once again.

What´s driving this ‘lackluster’ process?

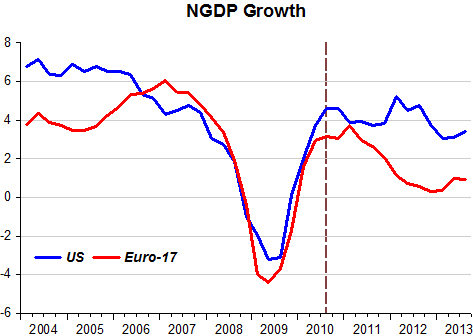

The next chart may provide a ‘motive’ for the lack of ‘energy’ observed in industrial production (and also in world trade). The chart shows the behavior of NGDP growth in both the US and Euro 17 countries (which represent a significant chunk of world demand).

Note that the rebound in nominal demand growth peters out towards the end of 2010, at a level significantly below the pre-crisis growth and before anything approaching the previous level of demand was regained. In the EZ, in April and June 2011 the ECB thought it wise to raise interest rates! In the US the sequence of QEs certainly helped avoid an even bigger disaster. Avoiding disaster is good, but so much more could have been done.

Be the first to comment on "World industrial production and trade lack of energy"