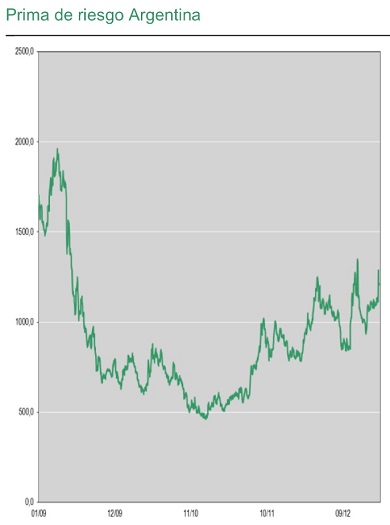

Meanwhile, in Argentina, the risk premium on the country’s sovereign debt has risen by +120 basis points during the first months of 2013. Apart from Venezuela, where the variation has been a -53 drop, the jump in market credit costs for the rest of the Latin America rests below +30. To find the answer to this stark contrast, BNP Paribas analysts said today in a note to investors that we must go to the Thurgood Marshall United States Courthouse in New York.

Last year, the US court sentenced the Cristina Kirchner government to pay their due to the bondholders who didn’t accept a 70 percent haircut of restructuring offers made in 2005 and 2010. That would be $1.33 billion. Now, the court has allowed the Argentinian Treasury to suggest a new agreement by next March 29, which some observers have eyed as a new chapter in international arbitration. But markets are showing little patience.

Argentina has so far led investors to believe that it is ready to default if necessary. That reaction, although less than surprising, would worsen further the lack of credibility of the Argentinian authorities. It looks like a no-win situation for everybody involved.

Be the first to comment on "Oops, Cristina Kirchner did it again"