All over the world the following train of thought is becoming prevalent: “The resumption of growth in the US and the accompanying change in monetary policy will lead to a strengthening of the dollar that should persist for a long period.”

What a presumption! But why has this “resumption of growth” view spread like ‘bush fire’?

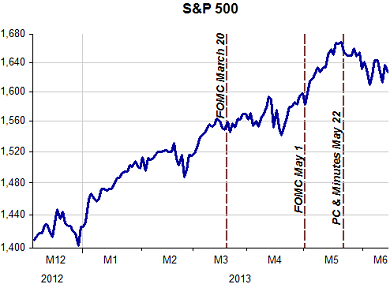

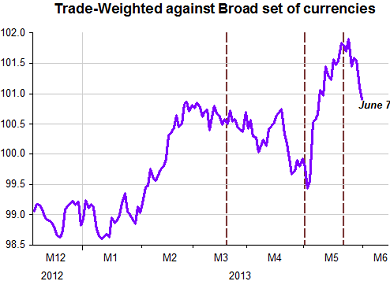

After the March 20 FOMC meeting the perception must have been that the so-called Evans-Rule and asset purchasing was not generating enough traction. In what I call the ‘map of the evidence’–the set of charts at the end–at about that time inflation expectations turned down, the stock market took a ‘breather’, the 10 year bond yield dropped and the dollar fell against a broad set of currencies.

The statement from the May 1 FOMC meeting was ‘criminal’, containing highly ‘poisonous’ (new) words, to wit: “The Committee is prepared to increase or reduce the pace of its purchases to maintain appropriate policy accommodation as the outlook for the labor market or inflation changes.”

When the press reports that the Chief-of-Staff notified the President that “the army is prepared”, the likelihood of a ‘fight’ looming up ahead increases markedly! And by ‘fight’ here nobody thought the Fed was contemplating an increase in purchases.

And things changed but not all in the expected direction. For instance, while expected inflation continued to slide, consistent with a premature ‘tightening’ of monetary policy, the long bond yield, the stock market and the dollar exchange rate went up strongly.

Sensing things were not ‘kosher’, on May 22 Bernanke switched the order of ‘releases’, doing the press conference prior to the release of the minutes of the May 1st FOMC meeting. This is the core of Bernanke’s statement at the PC: “Recognizing the drawbacks of persistently low rates, the FOMC actively seeks economic conditions consistent with sustainably higher interest rates. Unfortunately, withdrawing policy accommodation at this juncture would be highly unlikely to produce such conditions. A premature tightening of monetary policy could lead interest rates to rise temporarily but would also carry a substantial risk of slowing or ending the economic recovery and causing inflation to fall further. Such outcomes tend to be associated with extended periods of lower, not higher, interest rates, as well as poor returns on other assets. Moreover, renewed economic weakness would pose its own risks to financial stability.

“Because only a healthy economy can deliver sustainably high real rates of return to savers and investors, the best way to achieve higher returns in the medium term and beyond is for the Federal Reserve–consistent with its congressional mandate–to provide policy accommodation as needed to foster maximum employment and price stability. Of course, we will do so with due regard for the efficacy and costs of our policy actions and in a way that is responsive to the evolution of the economic outlook.”

But shortly after, when the Minutes were released the ‘world changed’: “Participants also touched on the conditions under which it might be appropriate to change the pace of asset purchases. Most observed that the outlook for the labor market had shown progress since the program was started in September, but many of these participants indicated that continued progress, more confidence in the outlook, or diminished downside risks would be required before slowing the pace of purchases would become appropriate. A number of participants expressed willingness to adjust the flow of purchases downward as early as the June meeting if the economic information received by that time showed evidence of sufficiently strong and sustained growth; however, views differed about what evidence would be necessary and the likelihood of that outcome. One participant preferred to begin decreasing the rate of purchases immediately, while another participant preferred to add more monetary accommodation at the current meeting and mentioned that the Committee had several other tools it could potentially use to do so.”

What’s the quantitative dimension of “a number of participants?” And this ungodly group would like to see a move to ‘tightening’ this Wednesday (June FOMC meeting).

The market’s reaction this time was more ‘sensible’. Inflation expectations continued to fall, the stock market reversed as did the dollar (contrary to the “resumption of growth” crowd). The only thing moving in the ‘wrong’ direction was the long yield. But remembering Bernanke’s words above, this is likely “temporary”. On this topic see Lars’ post.

Evan Soltas nails it when he says: “If the Fed can’t clarify without tightening, that’s a big problem for monetary policy. The next few stages of the exit are necessarily complex. If it wants to avoid snuffing out the recovery, the Fed will need to clarify its clarifications. Next week won’t be a moment too soon.”

Be the first to comment on "The presumption of US resumption of growth"