Member of the Executive Committee of the European Central Bank Peter Praet (a German, of course) has been forced to instruct us about the budding economic recovery and how fragile it is. You may consult the charts here.

Firstly, he claims that such incipient recovery is really brittle and lacks essential elements, which foretells a long absence of investment –let’s not forget that this is an essential element in any recovery process.

The euro area economy is seeing the infancy of a frail recovery. The turn-around in economic conditions that we have observed earlier in the year will bring citizens some relief after an exceptionally long phase of negative growth. But it will be some time before economic conditions will normalise. We expect credit to enterprises to lag behind, as we have experienced in past recoveries. Probably, the retarded reaction of productive credit to a change in economic conditions will be even more delayed this time, as households and companies, as well as banks, are trying to reduce their debt. Investment, as a consequence, has not bounced back yet – and probably will not for a while – at the same speed that is customary to see in the early quarters of an economic upturn. Unemployment has settled at unacceptably high levels. Part of it will be reabsorbed as companies will start hiring on more favourable demand prospects. But a fraction will trail, as it will take time for the longer-term unemployed to adapt to the post-crisis dislocations in the labour market.

Secondly, we find the subjugation of the so-called “Very Serious People” or VSP to the watchful Authority, according to Paul Krugman…

But I will also be clear on the limits to monetary policy actions. The ultimate source of growth and employment is not monetary accommodation. It is a competitive environment, a highly skilled workforce and a sound financial system.

…which is practically the same than what ‘ayatollah’ Weidmann recently said:

Bundesbank’s Jens Weidmann, declaring that “the money printer is definitely not the way to solve [Europe’s problems].”

If the only source of growth is a “competitive scenario, with a highly qualified workforce within a sound financial system,” then we are in trouble because there is none of those three elements right now. Furthermore, we have actually gone back 5 years. The VSP usually thinks that “money doesn’t matter” because the law of Say is enforced now and always. So then, why don’t they close the European Central Bank?

Besides, we are in the same situation if we don’t recognize that those three elements have deteriorated as a result of the ECB’s policies under orders from the Bundesbank, which was commanded by Angela Merkel. And the thing is that, the economic recovery is impossible with a falling inflation and the real interest rates so high (remember that the important ones are the private rates, not the public ones).

Demand is the beginning of the recovery: if it’s stable, then supply will invest, increase capacity and finally hire. This is the process that makes the economy grow. We agree that investment is crucial, but even Praet admits that it will take quite a long time. He claims that the ECB can do nothing to strenghten the economic recovery. I don’t know, maybe the central bank could have done something to avoid falling into this crisis. After all, that’s what the FED did, and the comparative figures are eloquent.

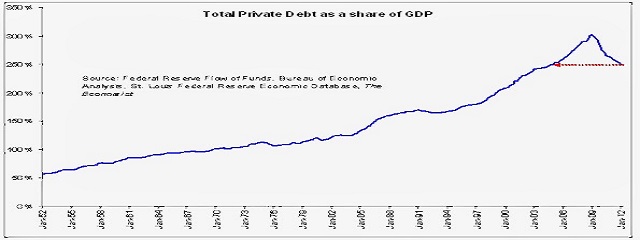

Which is the basic difference then? Simple. The FED provided unconditional liquidity, whereas the ECB provided conditioned and intermittent liquidity, which ended in a highly indebted private sector, with increase in taxes and expenditure cut. The result? The US is now slowly growing and its private sector has reduced its indebtedness, while Europe continues to suffer, its GDP is far from the pre-crisis levels, and the ratio debt/GDP remains halted.

So, why do they assume that everything lost during these years won’t affect the recovery process? The truth is that such loss wasn’t for free; if only because it delayed the debt reduction.

Be the first to comment on "ECB Doctrine (e.d. Bundesbank’s)"