The OECD attempted to focus the minds of European policy makers with its latest report on Tuesday, stating that a failure to act could lead to “a period of prolonged stagnation” in the euro zone. The Paris-based think-thank cited persistent uncertainty in Europe as the main drag on global economic growth, and urged policy makers in the EU to take decisive steps in a bid to transform the continent’s outlook.

In a significant message to the ECB and EU politicians, the report said “in the euro area, and for the global economy as well, intensified monetary support is critical to growth”. The report included the suggestion that the ECB “may have to purchase government bonds equivalent to of 7 % of GDP to reduce long-term yields”. Such definitive language is a departure from previous statements, and is a sign of the growing consensus for “unconventional” stimulus measures still opposed by some EU member states, most notably Germany. In addition, the report also suggests the easing of fiscal adjustment programmes which would help to boost demand and inflation.

The OECD offered cause for optimism on the Spanish economy, stating that the economy was likely to continue to grow, owing to a combination of improving labour market conditions and increased exports. Private consumption is forecasted to grow by 1.3% this year, 1.7% next year and 1.9% in 2016.

The report expects a further drop in unemployment to 24.5% by the end of this year, but noted that it “will remain high,” with the figure remaining above 20% in 2016. The report urged the Government to improve training facilities for the long-term unemployed, while noting that medium growth projections could be enhanced by further improvements in innovation and competitiveness.

The OECD sounded a note of caution with regard to the public finances, commenting that the public debt to GDP ratio would exceed 100% by 2016. To address this, the organisation counsels a monitoring of public sector efficiency measures, while also highlighting that the Government should have contingency measures in place in the event that revenues are below projections.

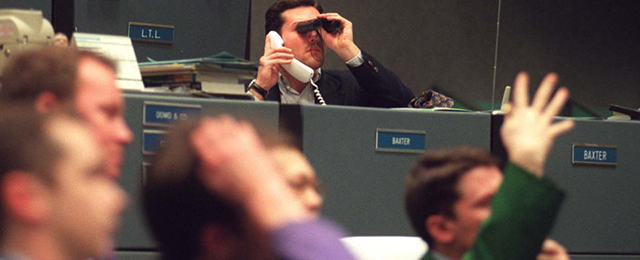

Credit lending will act as a drag on the growth rate in the medium term, and the report adds that while growth is expected to continue progressively in 2015 and 2016, the level of debt means Spain is vulnerable to any increased volatility on financial markets.

Be the first to comment on "When even the OECD calls to “start engines” of growth"