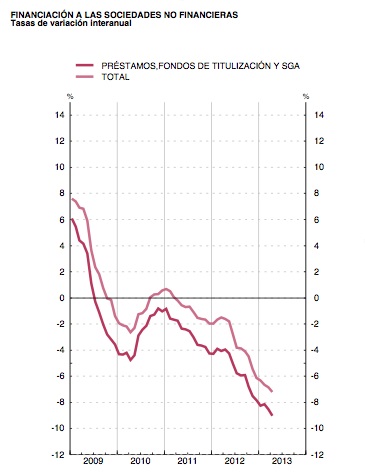

In Spain, credit to non-financial companies is falling this year at an annual rate of 9%, which is even higher than at the peak of the crisis back in 2009–evidently, it was the peak of the crisis for the few countries whose economies now grow, but not for Greece, nor Italy, or Spain, either.

If we were about to exit the recession, this is the rate that would change. Paul Krugman might be right: domestic credit is down, cumulative demand is down, and the financial system can hardly catch its breath. The European Central Bank, meanwhile, is doing little to balance this situation. The truth is that it makes no sense to call us a monetary union and then require a balance of payments against our European neighbours–it would be like forcing Iowa to have a balanced trade with Texas, and Texas with California, and so on. What we need is a sustainable financial balance to cover trade divides.

So the Eurozone is not a monetary union, but a mirage that’s increasingly painful to keep up with. We can only see green shoots by closing one eye as to avoid most of the real economic data.

Because if we open our eyes, the so much hailed rebalancing of the Eurozone is to a large extent the consequence of an internal demand contraction: investment has dropped, working capital has dropped and employment has followed their track of misery. Our trade balance has improved if only a tiny bit–which when reached -10% of GDP everybody said it didn’t matter because we were in the Eurozone, after all…

If the Spanish economy recovers, expect our domestic demand to increase and our trade balance to lose steam. Otherwise, the internal demand will continue its fall and unemployment rates will escalate.

If we are a monetary union, there can be no buts or ifs. Spain needs capital to implement its reforms and restore its economy. It needs to let assets and liabilities, and goods and services to adjust so they look attractive to lenders and investors.

Instead, Brussels and Madrid have so far done the opposite. Now, investing in Spain–and most European peripheral countries–seems risky and the shadows of defaults loom everywhere. That is, in the end, what you get by worshipping the Brussels austerity as the one and only policy.

Be the first to comment on "How Brussels austerity killed our economy"